Our News

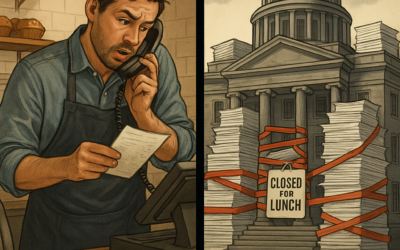

The Hidden Cost of Australia’s Growing Bureaucracy on Small Business

Big businesses are getting all the help.Small businesses are getting all the...

The Federal Budget just threw small business under the bus

The Federal Budget just threw small business under the bus—here’s why it...

New Lending Rules to Make Homeownership Easier for Australians with HELP Debt

The Government recently announced important updates to financial regulations,...

Stop Making These Costly Tax Mistakes: Uncover Hidden Pitfalls High Earners Must Avoid!

Discover how to avoid common yet costly tax mistakes with our expert advice, ensuring high net worth individuals and business owners make informed, strategic tax decisions.

Federal Budget updates for Financial Year 2025

2024/25 Federal Budget Overview 2024/25 Federal Budget Overview Personal...

From Chaos to Clarity: How Xero Transforms Small Business Accounting

Imagine drowning in a sea of receipts, invoices, and financial statements. The...

What You Need to Know About Property Tax When You Move into Your Rental Property

Do you own a rental property that you want to make your principal residence?...

How to Avoid the ATO’s Crypto Crackdown and Keep Your Profits

How to Avoid the ATO’s Crypto Crackdown and Keep Your Profits Cryptocurrency...

Happy New Financial Year 2024

MDB Taxation & Business Advisors Wishes You a Prosperous New Financial...